ESG aspects are increasingly integrated into the business.

The Board of Directors guides the company in pursuing the creation of sustainable value for shareholders and other stakeholders over the medium to long term. Priority environmental, social and governance issues, and in particular the climate, are integrated into the agenda of the Board of Directors and into the priorities of top management, also by linking them to specific sustainability objectives in managerial incentive schemes.

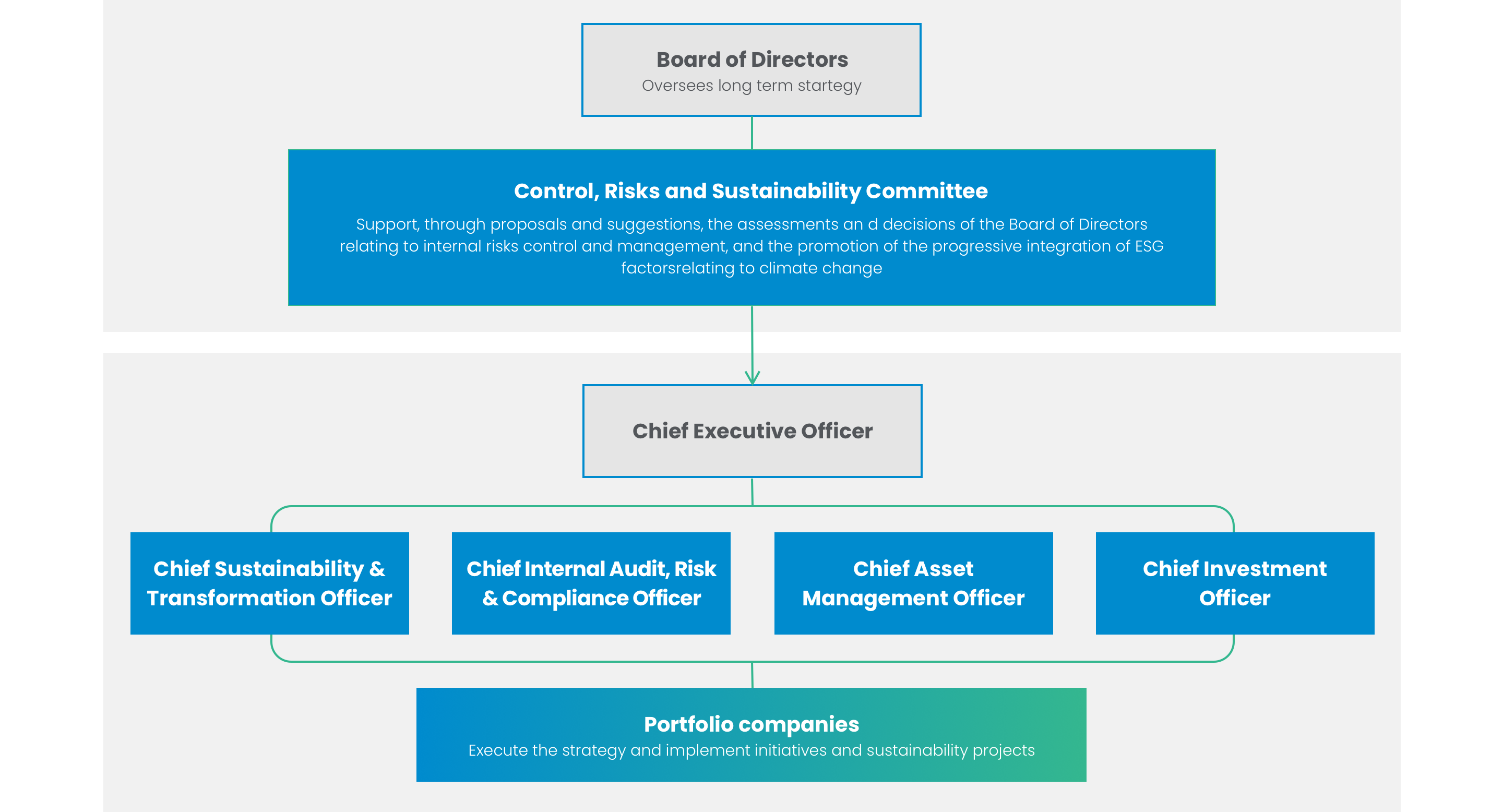

Sustainability in our Corporate Governance

Board of Directors

Oversees long term strategy

Control, Risks and Sustainability Committee

Support, through proposals and suggestions, the assessments an d decisions of the board of Directors relating to internal risks control and management, and the promotion of the progressive integration of ESG factorsrelating to climate change.

- Chief Executive Officer

- Chief Sustainability & Transformation Officer

- Chief Internal Audit, Risk & Compilance Officer

- Chief Asset management Officer

- Chief Investment Officer

Portfolio Company

Execute the strategy and implement initiatives and sustainability projects

Codes and Policies

The principles of ethics, integrity and transparency are guided in daily operations by specific policies and guidelines.

Our Code of Ethics represents the core of values we believe in, conceived as guiding principles of our corporate identity and our daily actions.

We are committed to preventing and combating illegal practices through the Anti-Bribery Policy, an organic framework of rules adopted by the Group.

In line with international best practices and in full compliance with the applicable regulations, Mundys has implemented a process for the collection and management of whistleblowing disclosures

The Policy aims to establish and maintain a constant, ongoing relationship with the Company’s Stakeholders through active listening and dialogue based on the principles of fairness and transparency, with the aim of facilitating the creation of long-term value in compliance with the applicable legislation.

The Diversity, Equality & Inclusion Policy codes our commitment to creating a work environment where everyone’s plurality and diversity are respected, valued and included.

We have chosen to adopt a structured approach to guide investment decisions and management of our asset portfolio, combining the need to achieve a return on our investments with a positive social and environmental impact, in line with the primary goal of creating long-term value for all our stakeholders.

The establishment of our Sustainability-Linked Financing Framework marks an important step in the process of aligning financing strategy with our mission, objectives and sustainability targets towards 2030 and beyond. Our Sustainability Financing Framework has been reviewed by Sustainalytics who provided a Second Party Opinion.

We have adopted the "Responsible Lobbying” Protocol, a document setting out the Group's guidelines for clear and transparent lobbying activity, aimed at avoiding the risk of undue influence, given also the lack of a defined regulatory framework for the sector.

The framework aims at monitoring and ensuring respect for and protection of human rights in every aspect of its business and value chain, with the aim of maintaining an ethical, safe and fair working environment.

The remuneration policy is developed according to the principles of transparency and sustainable value creation

The tax strategy sets out our objectives and approach in managing tax and represents the Board of Directors’ wish to implement an internal tax control framework (the Tax Control Framework or “TCF”) that is fully compliant with international standards and agreed with the OECD and tax authorities in Italy and in the other main countries in which the Group operates.